Investing & The Rule of 72

This is not financial advice!

What do you do for money? Do you enjoy it? What would you do if you didn’t have to think about your income? Personally, I like what I do, but if I had the choice to do ANYTHING? I would focus on being creative and adding value through education and mentorship.

This conversation was brought up by a financially savvy family member, who brought up the classic:

Put a set amount of money aside and invest it early and you will be surprised by the compounding interest you will make in the long run

It's not like I didn't ‘know’ this, but it sparked my interest to see if I can learn anything new.

The story goes like this, I'm from a financially well-off family, but most of their income was based on their jobs. I realized that model was not going to work for me long term, so how else can I make my money? I first thought, business. I wasn't totally wrong, but I wasn't right either.

Over the years I've started to realize that people who are financially independent are all asset-rich, not necessarily ‘’businessmen” in the sense of the word. A business can be a source of income, but it will never make you financially independent, you still depend on the business doing well and the hours you spend there to make your income.

Building assets is - as I've found out - very expensive. Buying real estate for example (the golden standard of asset classes) is out of my budget range. So in my case, I went towards buying into real estate investment trusts (a fancy term for basically real-estate stocks - learn more here).

Now I'm not sure if any of this will pay off, I'm no financial guru, and this is not financial advice. I just want to reach a point in about 10 years where I have enough of a portfolio of assets that I can be financially independent of my day job.

This whole write-up was just my thought process, but maybe you have a better method of financially diversifying. If so let me know and I'll try that out too and share it with anyone else who wants to learn. For now, I suggest setting up a “don't touch this money” account and setting aside 10% of your monthly income (or what you can) and investing it.

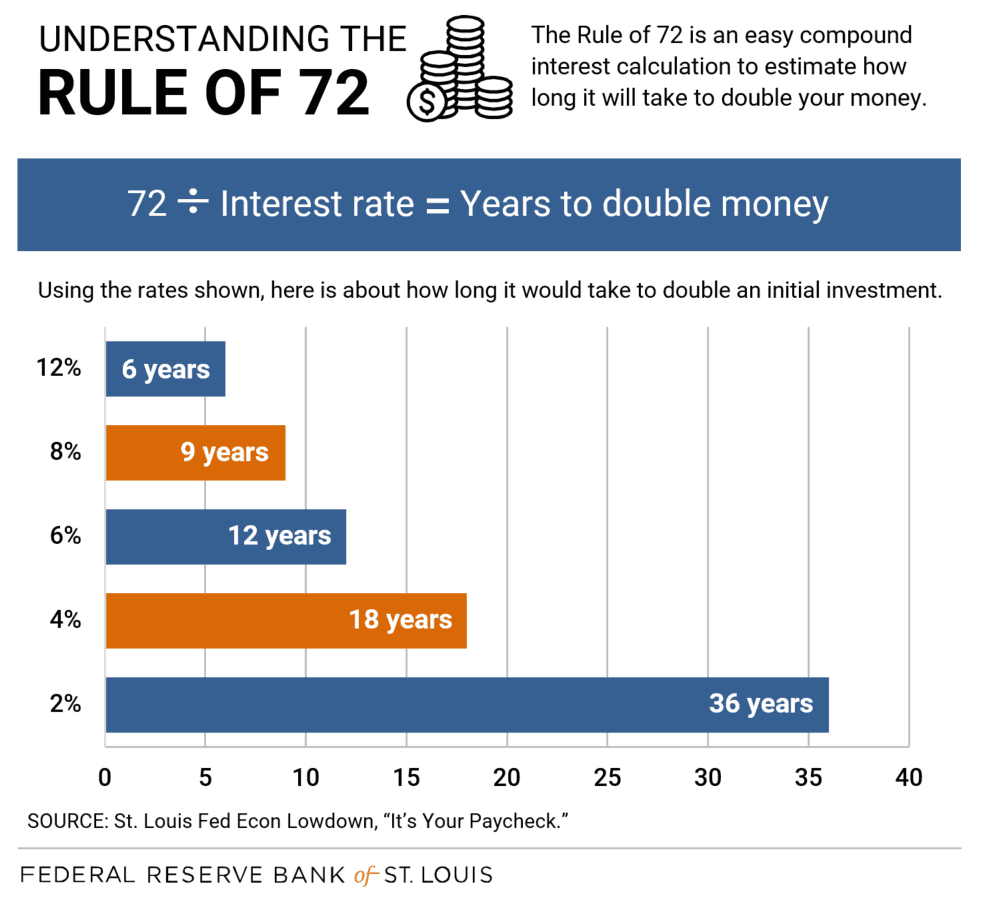

Oh, right, this is a graphic for what the Rule of 72 is:

Sources:

https://www.rocketmortgage.com/learn/reit

https://www.stlouisfed.org/open-vault/2018/september/how-compound-interest-works